Diminishing value depreciation example

It has been decided to depreciate it at the rate if 20 percent pa. Less Expenses Admin Expenses Depreciation on Truck 7040 Extract from the.

Written Down Value Method Of Depreciation Calculation

That is 80000 minus the 32000 decline in value in.

. Depreciation is applied at a fixed proportion to the. Address Line 1. In this case we know this amount is 20000.

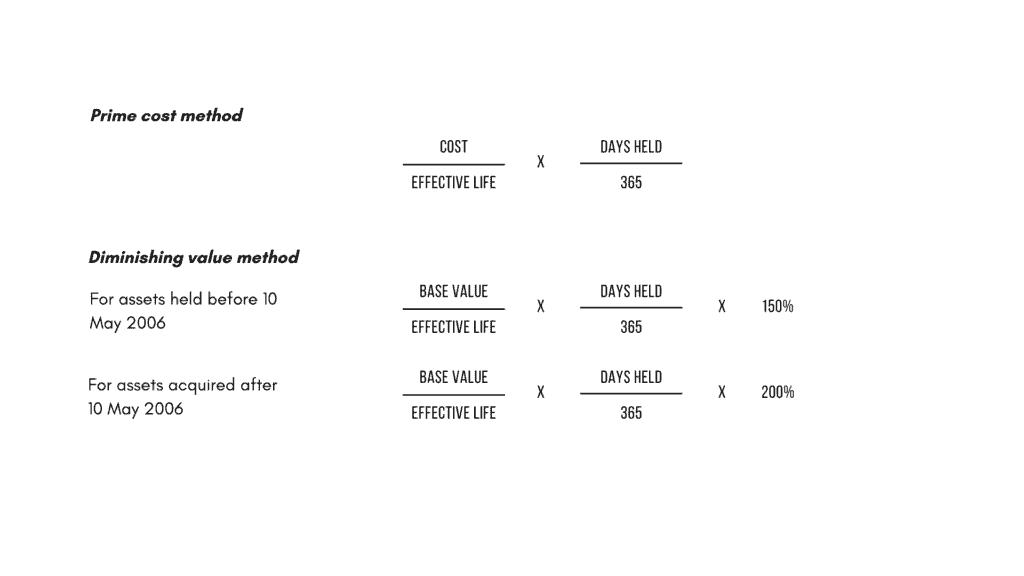

Depreciation 500000 x 10100 x 912 37500. The following formula is used for the diminishing value method. Base value x days held 365 x 200 assets effective life For instance if the cost of an.

On the diminishing balance. Example 11142018 At-Fault Drivers Name. Cost value 10000 DV rate 30 3000.

Therefore a suitable amount called depreciation charge must be set aside annually so that by the time thelife span of the power plant is over the collected amount equals to the cost ofthe repla See more. Depreciation 462500 x 10100 46250. Example 123456-2 Date of loss.

Depreciation 416250 x 10100 41625. Diminishing Balance Method Example 1. If the asset cost 80000 and has.

The rate of depreciation is applied to the diminishing value of the asset. Dear ________ With regards to the insurance. For example if an asset has a purchase price of 1000 and has been depreciated by 500 using the diminishing balance method then its net book value would be 500.

On 1st January 1994 a merchant purchased plant and machinery costing 25000. Meanwhile when it comes to diminishing value method you will use this formula. Diminishing Value Depreciation Method If an asset costs 50000 and has an effective life of 10 years your first years deduction will be.

This means the base value for the second year will be 48000. When using the diminishing value method you would record the final years depreciation as the difference between the Net Book Value at the start of the final period here. 26 rows Example of Diminishing Balance Method of Depreciation.

A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten. Depreciation - DV method 18Extract from the Income Statement for the year ended 31 March 2005. 80000 365 365 200 5 32000.

50000 x 365 365 x. The reduction in the value of the equipment and other property of the power station every year is known as depreciation. Depreciation 374625 x 10100.

On 01042017 Machinery purchased for Rs. Example of Diminishing Balance Method. Let us understand with the help of some examples.

The residual value is how much it will be worth at the end of its life. First Year diminishing value claim calculation. Diminishing Balance Method Example 1.

A XYZ limited purchases a. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. The base value reduces each year by the decline in the value of the asset.

That means the submarine is going to depreciate by 80000. Assets cost days held365 Depreciation rate. For subsequent years the base value will reduce based on the difference between.

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Straight Line Vs Reducing Balance Depreciation Youtube

Working From Home During Covid 19 Tax Deductions Guided Investor

How To Use The Excel Db Function Exceljet

Depreciation Methods Principlesofaccounting Com

Rate Adjustments Diminishing Value Depreciation Method Oracle Assets Help

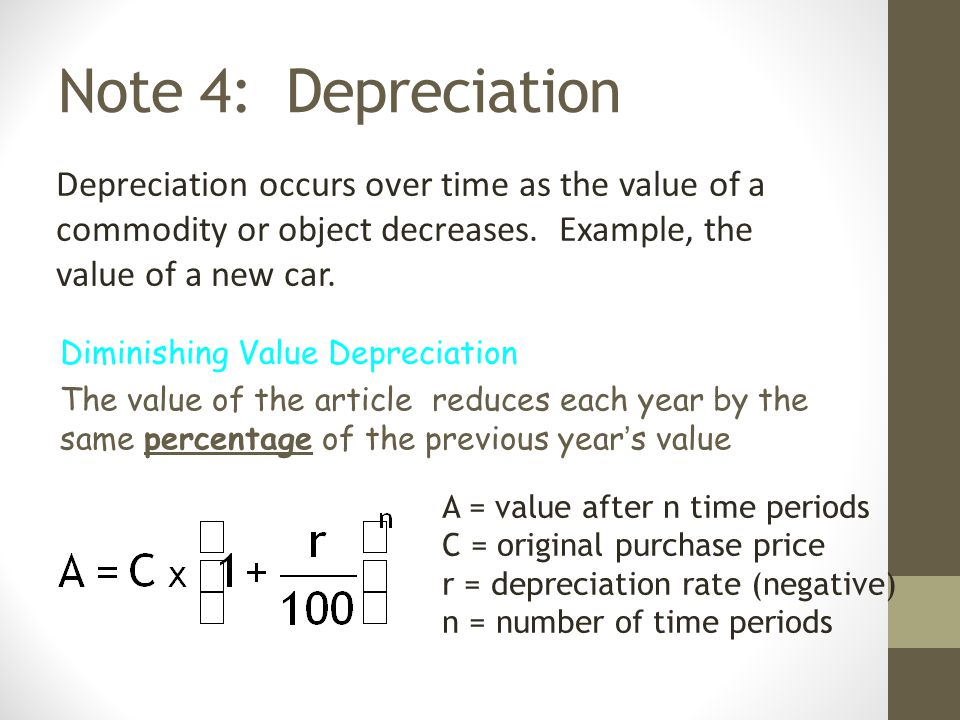

Note 4 Depreciation Depreciation Occurs Over Time As The Value Of A Commodity Or Object Decreases Example The Value Of A New Car Diminishing Value Ppt Video Online Download

Depreciation Highbrow

Depreciation Calculation

Depreciation Of Vehicles Atotaxrates Info

Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Choosing Depreciation Methods Diminishing Value Vs Prime Cost

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors